FinanceHub

— Smarter Finance, Less Effort

FinanceHub helps finance teams close faster, cut manual work, and make better decisions with live numbers.

Built on the datahub+ platform, it connects to your accounting system in minutes, automates reconciliations and routine workflows, and delivers real-time insights—no IT or data expertise required.

Already have a project in mind?

Connect With UsUse Cases of FinanceHub

Automated Reconciliation

Match invoices, payments, and orders automatically so records line up without manual checks. This cuts repetitive work and reduces copy-paste errors during the close.

Live Dashboards

Auto-refreshing reports in Power BI, Excel, and Looker Studio keep KPIs current. Stakeholders can view the same numbers in dashboards or spreadsheets without exporting data.

Cash Flow Monitoring

Real-time alerts and predictive insights help teams spot shortfalls and timing issues earlier. Finance can act sooner, improving day-to-day liquidity decisions.

Budget Tracking

Consolidated views from multiple systems bring actuals and plans together in one place. Teams compare performance at a glance instead of jumping between tools.

Sales-Finance Sync

Automate commissions and invoice generation so handoffs between sales and finance happen on time. Triggered workflows keep work moving across departments.

Why FinanceHub?

Automation That Shortens the Close

Eliminate manual reconciliations, repetitive reporting, and data entry with rule-based, scheduled workflows. Free your team to focus on analysis while FinanceHub handles the busywork reliably in the background.

Plug-and-Play Integrations

Connect your accounting/ERP systems—online or offline—along with banks, spreadsheets, and databases in minutes. Unified, synced data means fewer exports, fewer CSVs, and one source of truth.

Precision Calculations You Can Trust

Apply allocations, transformations, and multi-step formulas with versioned rules and validations. Every metric is traceable back to the originating transactions for audit-ready confidence.

Live Reporting Where You Work

Power dynamic dashboards and spreadsheet models with real-time or incremental refresh. Stakeholders see the latest KPIs instantly, with filters, drilldowns, and shareable views.

End-to-End Workflow Orchestration

Route approvals, trigger tasks, and notify the right people across finance, sales, and operations. SLAs, hand-offs, and alerts keep processes moving—no more email chases or swivel-chair updates.

Why FinanceHub?

Make Finance Work Smarter

FinanceHub empowers your team to:

- Focus on strategy, not spreadsheets

- Make faster, smarter decisions

- Collaborate seamlessly across departments

Whether you're a CFO, financial manager, or part of a growing finance team, FinanceHub is your gateway to clarity, speed, and confidence.

GET STARTED

Key Benefits of FinanceHub

No IT Required

Connect your ERP/accounting tools in minutes with guided, self-serve setup. Governed templates, role-based permissions, and reusable pipelines let finance build and update processes without waiting on engineering.

Time Saved

Automate reconciliations, allocations, and recurring reports on schedules or triggers. Close faster by eliminating copy-paste and manual joins across systems, cutting hours from month-end and weekly routines.

Accuracy Boosted

Rule-driven validations, duplicate detection, and audit trails catch errors before they hit reports. Data lineage and versioning provide traceability from dashboard back to source transactions.

Real-Time Insights

Stream or incrementally refresh metrics so dashboards, spreadsheets, and alerts reflect the latest postings. Track KPIs with thresholds and notifications to email/Slack when anything drifts.

Cross-Team Automation

Kick off approvals, hand-offs, and notifications between finance, sales, and operations. Integrations with CRM, billing, and procurement keep data in sync and remove swivel-chair work.

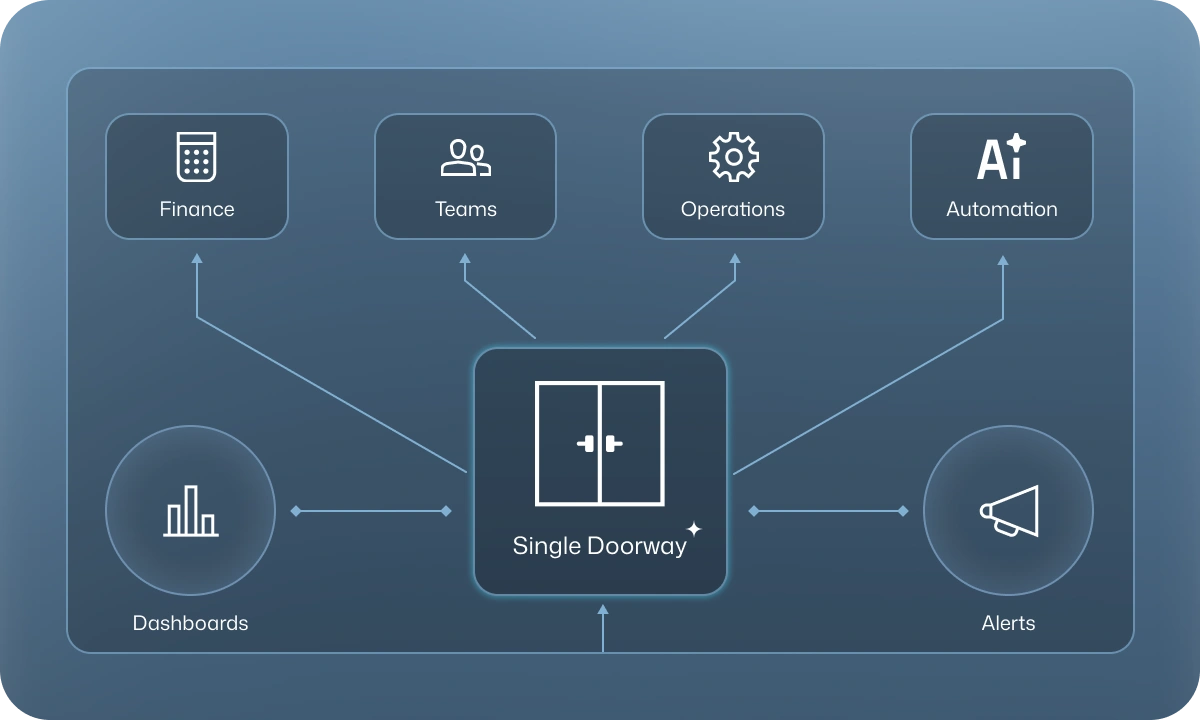

Built on datahub+ Core Pillars

FinanceHub leverages the six foundational pillars of datahub+

1. Connect

Link accounting systems, spreadsheets, and databases.

2. Transform

Clean and reshape financial data.

3. Context

Add business meaning (GL codes, cost centers).

4. Orchestrate

Manage workflows and approvals

5. Serve

Deliver insights via dashboards and spreadsheets.

6. Extend

Scale with new integrations and use cases.